10 Worst First-Time Homebuyer Mistakes

By Amy Fontinelle February 23, 2017 — 12:10 PM EST

Are you gearing up to buy your first place? Shopping for a home is exciting, exhausting and a little bit scary. In the end, your aim is to end up with a home you love at a price you can afford. Sounds simple enough, right? Unfortunately, many people make mistakes the prevent them from achieving this simple dream. Arm yourself with these tips to get the most out of your purchase and avoid making 10 of the most costly mistakes that could put a hold on that sold sign. (Don’t know even where to get started when purchasing a home? Check out Financing Basics For First-Time Homebuyers and our First-Time Homebuyer Guide.)

1. Not Knowing What You Can Afford

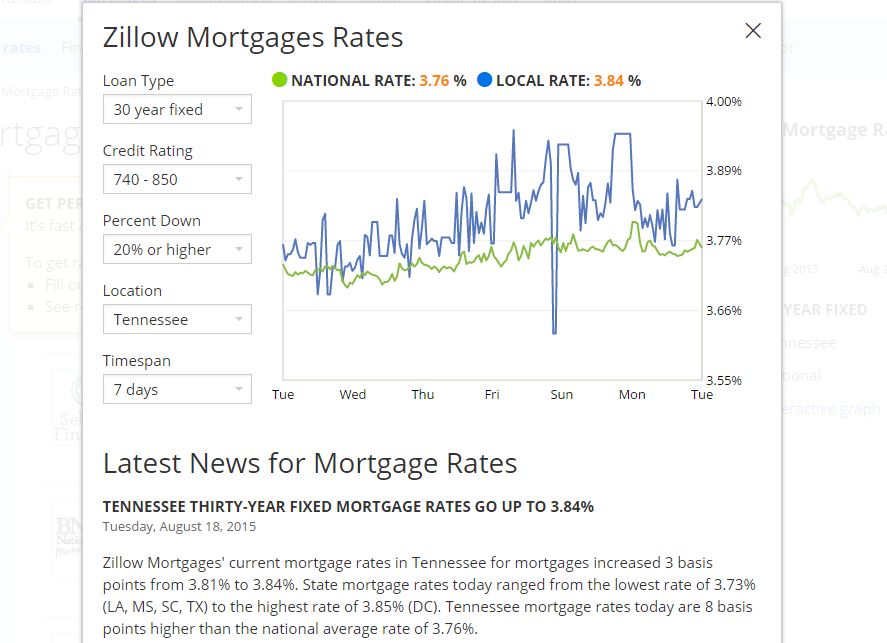

As we’ve all learned from the subprime mortgage mess, what the bank says you can afford and what you know you can afford or are comfortable with paying are not necessarily the same. If you don’t already have a budget, make a list of all your monthly expenses (excluding rent), including vehicle costs, student loan payments, credit card payments, groceries, health insurance, retirement savings and so on. Don’t forget major expenses that only occur once a year, like any insurance premiums you pay annually or annual vacations. Subtract this total from your take-home pay and you’ll know how much you can spend on your new home each month. When calculating this figure use a mortgage calculator to research current interest rates. This will give you an estimate of what your total mortgage payments will be.

If you end up looking at homes that are outside your price range, you’ll end up lusting after something you can’t afford, which can put you in the dangerous position of trying to stretch beyond your means financially or cause you to feel unsatisfied with what you actually can afford. You may even learn that you can’t afford the type or size of home that you desire and that you need to work on reducing your monthly expenses and/or increasing your income before you even start looking. (Read Six Months To A Better Budget and Get Your Budget In Fighting Shape to learn more.)

2. Skipping Mortgage Qualification

What you think you can afford and what the bank is willing to lend you may not match up, especially if you have poor credit or unstable income, so make sure to get pre-approved for a loan before placing an offer on a home. If you don’t, you’ll be wasting the seller’s time, the seller’s agent’s time, and your agent’s time if you sign a contract and then discover later that the bank won’t lend you what you need, or that it’s only willing to give you a mortgage that you find unacceptable.

Be aware that even if you have been pre-approved for a mortgage, your loan can fall through at the last minute if you do something to alter your credit score, like finance a car purchase. If you cause the deal to fall through, you may have to forfeit the several thousand dollars that you put up when you went under contract. (To learn more, read Pre-Qualified Vs. Pre-Approved – What’s The Difference?)

3. Failing to Consider Additional Expenses

Once you’re a homeowner, you’ll have additional expenses on top of your monthly payment. Unlike when you were a renter, you’ll be responsible for paying property taxes, insuring your home against disasters and making any repairs the house needs (which will occasionally include expensive items like a new roof or a new furnace).

If you’re interested in purchasing a condo, you’ll have to pay maintenance costs monthly regardless of whether anything needs fixing because you’ll be part of a homeowner’s association, which collects a couple of hundred dollars a month from the owners of each unit in the building in the form of condominium fees. (For more information, see Does Condo Life Suit You?)

4. Being Too Picky

Go ahead and put everything you can think of on your new home wish list, but don’t be so inflexible that you end up continuing to rent for significantly longer than you really want to. First-time homebuyers often have to compromise on something because their funds are limited. You may have to live on a busy street, accept outdated decor, make some repairs to the home, or forgo that extra bedroom. Of course, you can always choose to continue renting until you can afford everything on your list – you’ll just have to decide how important it is for you to become a homeowner now rather than in a couple of years. (For related reading, read To Rent or Buy? The Financial Issues – Part 1 and To Rent or Buy? There’s More To It Than Money – Part 2.)

5. Lacking Vision

Even if you can’t afford to replace the hideous wallpaper in the bathroom now, it might be worth it to live with the ugliness for a while in exchange for getting into a house you can afford. If the home otherwise meets your needs in terms of the big things that are difficult to change, such as location and size, don’t let physical imperfections turn you away. Besides, doing home upgrades yourself, even when you have to hire a contractor, is often cheaper than paying the increased home value to a seller who has already done the work for you. (For more information on remodeling, read our related article Fix It And Flip It. The Value of Remodeling.)

6. Being Swept Away

Minor upgrades and cosmetic fixes are inexpensive tricks are a seller’s dream for playing on your emotions and eliciting a much higher price tag. Sellers may pay $2,000 for minimal upgrades or pay several thousand dollars on staging. If you’re on a budget, look for homes whose full potential has yet to be realized. Also, first-time homebuyers should always look for a house they can add value to, as this ensures a bump in equity to help you up the property ladder.

7. Compromising on the Important Things

Don’t get a two-bedroom home when you know you’re planning to have kids and will want three bedrooms. By the same token, don’t buy a condo just because it’s cheaper when one of the main reasons you’re over apartment life is because you hate sharing walls with neighbors. It’s true that you’ll probably have to make some compromises to be able to afford your first home, but don’t make a compromise that will be a major strain.

8. Neglecting to Inspect

It’s tempting to think that you’re a homeowner the moment you go into escrow, but not so fast – before you close on the sale, you need to know what kind of shape the house is in. You don’t want to get stuck with a money pit or with the headache of performing a lot of unexpected repairs. Keeping your feelings in check until you have a full picture of the house’s physical condition and the soundness of your potential investment will help you avoid making a serious financial mistake.

9. Not Choosing to Hire an Agent or Using the Seller’s Agent

Once you’re seriously shopping for a home, don’t walk into an open house without having an agent (or at least being prepared to throw out a name of someone you’re supposedly working with). Agents are held to the ethical rule that they must act in both the seller and the buyer parties’ best interests, but you can see how that might not work in your best interest if you start dealing with a seller’s agent before contacting one of your own. (To learn more, read Do You Need A Real Estate Agent?)

10. Not Thinking About the Future

It’s impossible to perfectly predict the future of your chosen neighborhood, but paying attention to the information that is available to you now can help you avoid unpleasant surprises down the road.

Some questions you should ask about your prospective property include:

What kind of development plans are in the works for your neighborhood in the future?

Is your street likely to become a major street or a popular rush-hour shortcut?

Will a highway be built in your backyard in five years?

What are the zoning laws in your area?

If there is a lot of undeveloped land? What is likely to get built there?

Have home values in the neighborhood been declining?

If you’re happy with the answers to these questions, then your house’s location can keep its rose-colored luster.

The Bottom Line

Buying a first home can seem stressful and overwhelming, and it isn’t without its share of potential pitfalls. If you’re aware of those issues ahead of time, you can protect yourself from costly mistakes and shop with confidence.

For many people, a home is the largest purchase they will ever make, but it need not be the most difficult.

Be sure to read Investing In Real Estate to learn more about the perks of owning property.

Amy Fontinelle

Amy Fontinelle is a writer, editor, and personal finance expert. Her clients include personal finance websites, financial institutions, public policy organizations, academic journals and professional economists. She has written hundreds of articles on budgeting, credit cards, mortgages, real estate, investing and other topics. In addition to Investopedia, her articles have been featured on the homepage of Yahoo! and on Yahoo! Finance, Forbes.com, SFGate.com, Bankrate and other websites.

In addition to her personal finance articles, Amy writes business-to-business copy and composes ghostwritten and content marketing pieces. She polishes articles and papers written by economists, consultants and other professionals who need to communicate clearly and compellingly through their writing. She has also defined hundreds of financial terms for Investopedia’s online dictionary and written in-depth tutorials on budgeting, banking, investing and home buying. Learn more about Amy at www.AmyFontinelle.com.

Read more: Amy Fontinelle Bio | Investopedia http://www.investopedia.com/contributors/195/#ixzz4rxJ1npf2

Follow us: Investopedia on Facebook